This project will pay a portion of the royalties from the forthcoming 《Rich Dad Crypto Dad: Crypto Awakening》 to wallets that participate in the presale and continue to hold after listing, distributing monthly in USDT for one year.

Unlike typical tokens that lean almost entirely on the “post-listing price rise → cash out” path, RDCD strongly emphasizes the message that “cash flow accrues simply by holding.”

RDCD’s core message is simple: the more you buy in the presale, the larger your monthly royalty allocation becomes.

That holding incentive functions as a mechanism to lock up sell supply after listing while layering on a narrative of potential price appreciation.

RDCD’s official website places this structure front and center.

The simple condition that selling forfeits your right to the next 12 months of royalty income is presented as a mechanism that could alter market behavior.

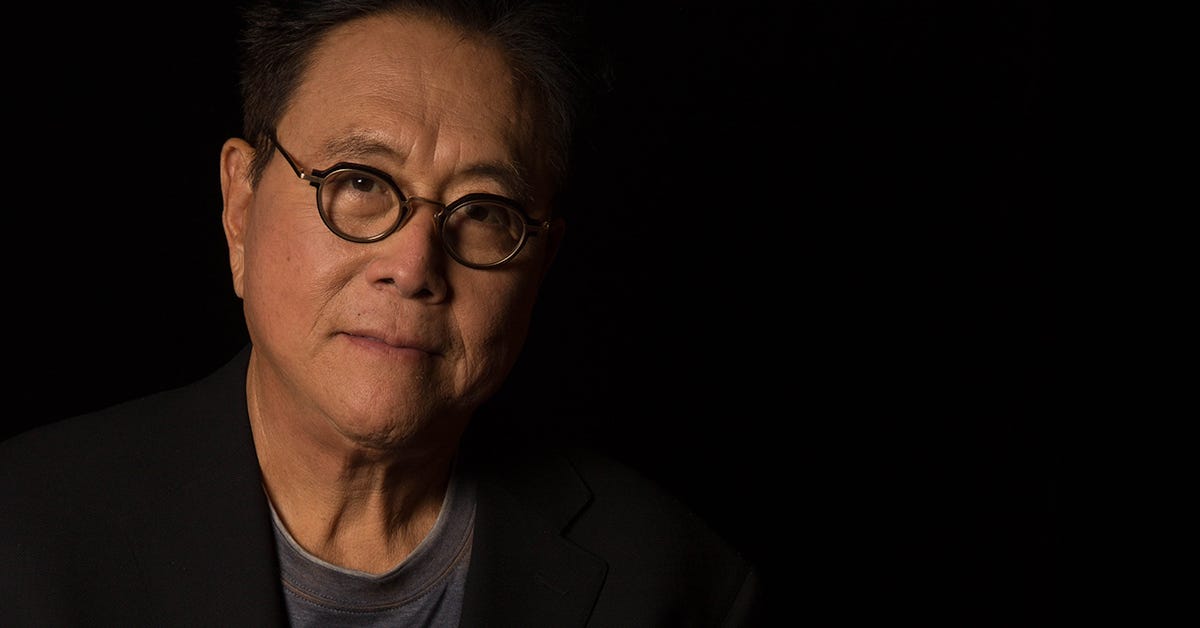

Looking into the RDCD project, the title of the soon-to-be-released book contains the keyword “Rich Dad.” That single word lets many people infer far too easily who the protagonist is that it’s Robert Kiyosaki. Although the name is not officially disclosed, the overall context and the project’s design only deepen that likelihood.

The project states that this author has recorded more than 100 million USD in cumulative royalties from the single IP 《Rich Dad Poor Dad》.

It connects that already-proven royalty-generating power to the new book and specifies that a portion of the proceeds will be allocated only to early holders who satisfy the dual condition of presale participation and continued post-listing holding.

By framing this as a “closed eligibility window,” it underscores that the opportunity exists solely during the presale period.

The logic of the structure compresses easily:

- to receive royalties you cannot sell →

- less selling narrows circulating supply →

- a tight float plus incoming attention and capital increases upward price pressure →

- while the price action plays out, monthly royalties keep accruing →

- at the eventual exit you capture both “price appreciation + accumulated royalties.”

Because the distribution formula is proportional to holdings, the psychology that “the larger the position, the larger the absolute monthly USDT” is reinforced.

A wallet that secures a large position in the presale recognizes that the same royalty rights cannot be replicated later through post-listing accumulation.

As a result, larger holders tend to share three narratives:

- greater absolute monthly USDT inflow,

- accelerated recovery of initial cost basis,

- added price leverage in any tight-supply scenario.

The choice presented to participants compresses to two variables: when to enter, and how much to secure.

According to the project’s explanation, those two coordinates linearly determine the next 12 months’ cumulative royalty total, the pace at which the perceived average entry cost declines, and the potential aggregate payoff at an eventual sale.

The recommended decision workflow is reverse-engineering from a target.

First set a desired monthly USDT royalty figure, then calculate the required RDCD share versus the presale-eligible pool, and finally choose execution timing based on the remaining stage allocation and price.

By repeatedly asserting that “the same conditions cannot be duplicated after listing,” the design pulls the decision clock forward into the presale window.

In summary, the RDCD presale message resolves into five lines:

Presale-only royalty entitlement,

A monthly royalty stream generated by holding alone,

A hold incentive that suppresses selling → constrained supply,

Proportional distribution that favors larger early accumulation,

A dual stack of accumulated royalties plus potential price appreciation.

If those five lines resonate, the RDCD design seeks to translate that resonance directly into a decision on timing and size of participation.

And behind all of this though not officially disclosed stands the 21st century’s bestselling author, strongly presumed to be Robert Kiyosaki.

![Bitcoin Cash [BCH] could be ready for another pump. Here's why...](https://www.blockchainnewsportal.com/wp-content/uploads/2023/08/Bitcoin-Cash-BCH-could-be-ready-for-another-pump-Heres-600x337.png)